Stay on top of your disbursals and collections with MPurse Payments Aggregation Solution

The reality of payments is digital.

Let’s ask you a simple question – when it comes to payments, what do your customers really want? Seamless experiences for disbursal and collection.

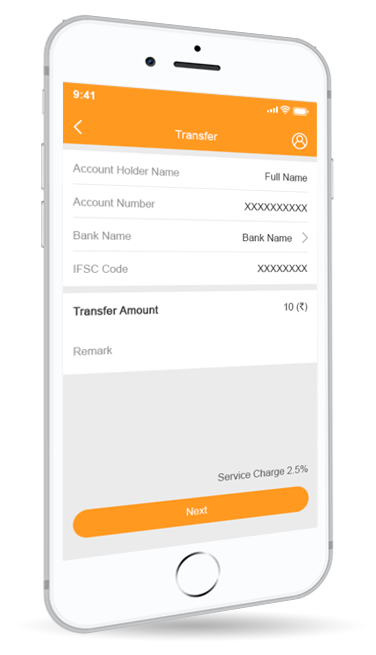

At MPurse, we empower businesses to process payment through mobile and digital modes from buyers. With one unified tech-enabled solution and secured infrastructure, we help you to disburse and collect payments from your customers in the most seamless and reliable manner, while helping your business scale.

Our payments aggregation solution takes care of collections as well as disbursals, ensuring end-to-end service, at all times.